Is Mumbai in a real estate bubble? Why or why not?

Is Mumbai in a real estate bubble? Why or why not? If so, which neighborhoods are the most vulnerable? Will the bubble burst? Why or why not?

In my humble opinion, Mumbai Real Estate market isn't a bubble which can crash anytime soon. My rationale:

1. In India real estate buying is also sentimental. It is a society where young generations are considered 'settled' when they can own a house, whether they can afford a house or not is irrelevant. This is one of the many reasons why 1BHKs are in demand always. Ask any builder.. 1BHKs are the fastest sell-outs.

2. While I understand demand and supply aren't balanced in Mumbai. The need does exist, which is why the affordable housing projects are not experiencing the slowdown which mid-level and upper mid-level segments are facing due to unaffordability. This has an easy cure, new launches in mid-level projects introduce a new configuration; 1.5BHK. This is a change many of you might notice in localities like Chembur, Kanjurmarg,etc.

3. New launches have dipped anyway. The focus by builders these days is on selling unsold inventory. Just like FSI and land locked PSUs are controlled by Govt to increase the value of existing land and create a false shortage. Same way builders can sit on their land banks and not launch new projects to sell what is already existing. Land is liquid if the pace of development and redevelopment is fast, but there needs to be infrastructure to support those.

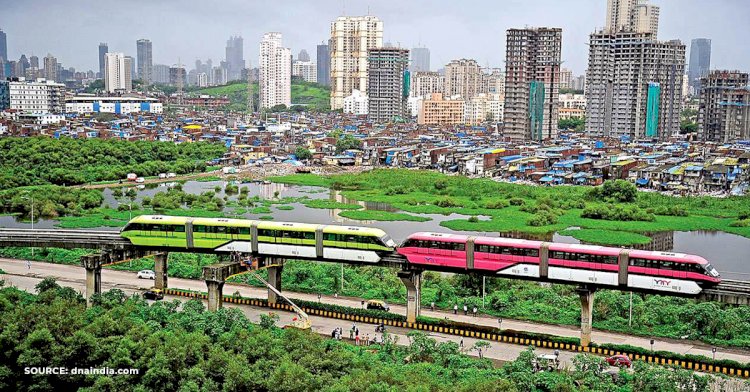

4. The above point brings me to an important point.. infrastructure. In the last 2 years we have seen Eastern Freeway, Santacruz Chembur Link Road, Versova Ghatkopar Metro. In the coming years we will see Nariman Point-Kandivali Coastal Road, Sewri-Nhava Sheva sea link, Chembur-Mahalakshmi Monorail(already operational till Wadala) and all the other Metro phases. Infrastructure improves attractiveness of a residential locality. This will improve the buyer sentiment and help them get off the fence they've been sitting on since the last government's rule.

5. BJP under Modi's leadership looks like a Government which is reform-led. Approval of REITs, promise of fastening the approval processes which in turn reduce delays and cut overheads, increased FSI, easing of FDI norms, reduction of Interest rates by RBI are all small but significant steps in the right direction towards improving the buyer and investor sentiment.

Also, check out Manish M. Nagori's answer to Are real estate rates in India really falling or is it just a notion / misinformation?

All in all, the current rates at the current infrastructure and norms might be unaffordable (for which you can always negotiate discounts in a market like today's). The fact that the deal might not stay as sweet because the government has also increased ready-reckoner rates in 2015 will continue to increase the unaffordability of real-estate. But then... stock market is rallying and all equity returns have a history of getting parked in real estate! Also, all you guys will get promotions which will translate into higher loan eligibility and better loan-repayment capacities!

Update: The Govt.'s focus on FDI will be a boon for the real estate industry. The Govt has eased the FDI norms to a great extent, this will just attract easier finance for the real estate community, so if you really hope that the prices are going down. I'm extremely sorry that you have very unrealistic expectations.

Disclaimer: I'm employed in a real estate sales job and my views might not appeal to consumers. We all have a liking towards reading things that will affect us positively, but then my optimism towards continued employment lends another perspective to you :)

What's Your Reaction?